1704 Chantilly Drive,

Suite 101

LaPlace, LA 70068

Mailing:

P.O. Box 2066

LaPlace, LA 70069

Contact:

PH: 985.359.6600

FX: 985.359.6602

info@stjohntaxoffice.com

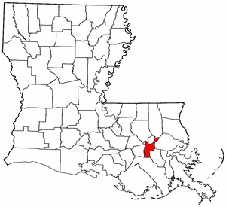

St John the Baptist Parish Occupational License Tax

The St. John the Baptist Parish Sheriff, as ex officio collector of

occupational license taxes for the Parish of St. John the Baptist, has

contracted with the St John the Baptist Parish Tax Office, operated by

ACI St. John, LLC (an Assured Compliance, Inc. company), for the

administration, operations, examination and information technology

services involved in the collection of all of the occupational

license, chain store, and insurance premium taxes levied in the

Parish.

Applications for Occupational License renewals, and all requisite taxes and fees, are due on January 1 of the license year, and are considered delinquent if not submitted prior to March 1. Insurance Premium Tax payments are considered delinquent if not submitted by June 1. Delinquent renewals and/or payments may be subject to additional interest, penalties, and additional fees as allowed by law.

New applicants are required to have completed the application process and be in receipt of an Occupational License prior to beginning business.

Follow these links for additional information, forms, and instructions.

LA OLT Law (Title 47, Chapter3)

Application for New Businesses

Renewal of Existing Businesses

Insurance Premium Tax

Chain Store Tax

Live Entertainment Permit Application

Link to SJBP Occupational License Ordinances in Municode

Applications for Occupational License renewals, and all requisite taxes and fees, are due on January 1 of the license year, and are considered delinquent if not submitted prior to March 1. Insurance Premium Tax payments are considered delinquent if not submitted by June 1. Delinquent renewals and/or payments may be subject to additional interest, penalties, and additional fees as allowed by law.

New applicants are required to have completed the application process and be in receipt of an Occupational License prior to beginning business.

Follow these links for additional information, forms, and instructions.

LA OLT Law (Title 47, Chapter3)

Application for New Businesses

Renewal of Existing Businesses

Insurance Premium Tax

Chain Store Tax

Live Entertainment Permit Application

Link to SJBP Occupational License Ordinances in Municode